If you’re a real estate investor or homeowner in California, you’ve probably heard about the power of the 1031 exchange rules. This tax-deferral strategy lets you sell one investment property and reinvest the proceeds into another, without paying capital gains taxes at the time of sale.

But here’s the catch: while 1031 exchanges are defined by federal tax law (IRC Section 1031) and apply across the U.S., California has additional rules and reporting requirements that investors must follow.

In this guide, your trusted Realtor Emily Martin will walk you through everything you need to know about the 1031 exchange rules California investors must follow, from the general federal rules to the unique obligations the state imposes.

What are the 1031 Exchange rules?

A 1031 exchange, named after Section 1031 of the IRS tax code, allows investors to sell one investment or business-use property and purchase another without paying capital gains tax at the time of the sale. The tax is deferred, not eliminated, and only applies when you eventually cash out.

This is especially helpful in California, where real estate often appreciates rapidly. Deferring taxes means you can reinvest more capital, grow your portfolio faster, and potentially pay lower taxes down the line.

Do You Qualify for a 1031 Exchange?

Not all properties or owners qualify for a 1031 exchange. Before diving into the rules, ask yourself:

- Is the property used for investment or business purposes? Your primary residence doesn’t qualify, but rental properties, commercial buildings, and even raw land held for investment do.

- Is your goal to reinvest in like-kind property? “Like-kind” doesn’t mean identical. In California, you can exchange a residential rental for a commercial property, or a multi-unit building for raw land, as long as it’s held for investment.

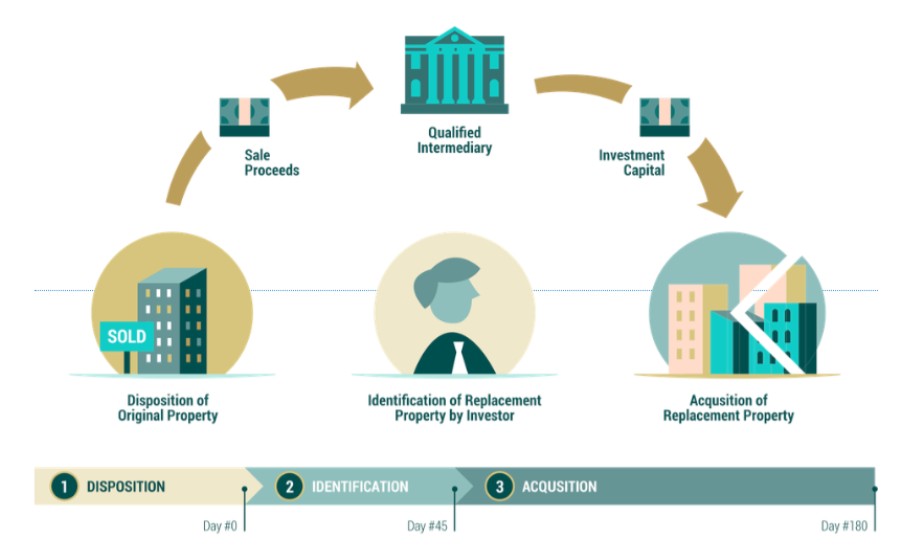

- Can you meet the required timeframes? You must identify a new property within 45 days of selling the old one and close within 180 days. This is a tight time frame, and it requires balancing finding a new place and then simultaneously selling the first place.

- Are you reinvesting the full value? To avoid capital gains taxes entirely, you need to reinvest all proceeds and maintain or increase your level of debt on the new property.

If you answered yes to all of the above, you’re likely eligible under the 1031 exchange rules California investors must follow.

1031 Exchange Rules California Investors Must Follow

Federal vs. California Rules: Know the Difference

Most of the rules for 1031 exchanges are set at the federal level by the IRS, and these apply to all U.S. investors, including those in California. However, California adds its requirements, particularly when it comes to tracking and taxing deferred gains on out-of-state exchanges.

Federal Exchange Rules

The following rules are part of the federal tax code, and they apply nationwide, including in California. These rules govern how many properties you can identify during your 45-day window. You must follow one of the three:

- Three-Property Rule: You can identify up to three properties, regardless of value, as long as you close on at least one.

- 200% Rule: You can identify any number of properties as long as their combined fair market value does not exceed 200% of your relinquished property’s value. For example, if you sell for $500,000, your identified properties must not exceed a total value of $1 million.

- 95% Rule: You can ignore the 200% limit and identify properties worth any amount, but you must purchase 95% of the total value of the identified properties. For example, if you identify $2.5 million in properties, you must close on at least $2.375 million worth.

If you fail to follow one of these rules, the exchange could be disqualified.

California Exchange Rules

- Property Must Be Like-Kind: The term “like-kind” is interpreted broadly. In California, you can swap an apartment building for raw land or a single-family rental for a retail space, so long as both properties are held for investment or business use.

2. Strict Time Limits

- Identify a replacement property within 45 days of selling your original property.

- Close on the new property within 180 days of the original sale.

These deadlines run concurrently, and missing either will disqualify your exchange.

- Use a Qualified Intermediary (QI): You’re not allowed to handle the sale proceeds yourself. A Qualified Intermediary must manage the funds and facilitate the exchange. Choose one with experience in California’s complex regulatory environment.

- California Franchise Tax Board (FTB) Tracking: If you exchange a California property for one out of state, the California FTB will still track your deferred gain. When you eventually sell the replacement property, even if it’s in another state, California may come after those deferred taxes. You must file Form FTB 3840 annually until the gain is recognized.

5. Reinvestment Must Be Equal or Greater: To defer 100% of your capital gains taxes:

- The replacement property must be equal to or greater in value than the one you sold.

- You must reinvest all proceeds and take on equal or greater debt.

Partial reinvestments are allowed, but you’ll owe taxes on the portion you keep.

Final Thoughts on 1031 Exchange Rules in California

The key to navigating a 1031 exchange successfully is understanding the federal foundation and California’s additional rules. While the potential tax savings are significant, so are the consequences of noncompliance.

If you’re considering a 1031 exchange in Healdsburg, Santa Rosa, or anywhere in California, work with an experienced real estate advisor and a tax professional. Understanding the 1031 exchange rules California enforces can help you defer taxes legally and reinvest with confidence.

As a trusted Sonoma County Realtor with an MBA in Finance, Emily Martin brings a strategic, data-driven approach to every transaction. As an experienced Luxury Realtor in California’s renowned Wine Country, she has extensive expertise guiding both buyers and sellers through complex 1031 Exchanges. Whether you’re exploring investment opportunities or considering the sale of a unique property, Emily would welcome the opportunity to assist you and share her deep market knowledge and financial insight.

Why choose Sonoma Realtor Emily Martin?

Emily has called California home for over a decade and likes to think of herself as a California “native.” Learning at a young age from her mother, Linda K. Martin, a top-producing real estate agent for 40+ years, Emily has been immersed in real estate all of her life. As a homeowner in her early 20s in Manhattan’s Gramercy Park, followed by San Francisco, and now Healdsburg, Emily understands the intricacies of home ownership in highly sought-after regions such as Manhattan, San Francisco, Sonoma County, Napa Valley, and her beloved hometown of Healdsburg, California.

Whether clients are buying their dream home, purchasing a second home, selling a cherished property, or investing in the market, Emily is here to make their dreams a reality. Her extensive luxury experience, attention to customer service, marketing expertise, strong work ethic, and passion enable her to provide a level of service that is truly distinctive.

As the journey begins, here’s what clients can expect:

Unmatched Luxury Expertise

With a deep-rooted understanding of the luxury market, Emily brings a wealth of knowledge and insight into luxury goods, sales, and lifestyle. Whether clients are buying or selling, she has the expertise to navigate the world of real estate and the Healdsburg Luxury Homes market.

A Tradition of Excellence

With a family legacy spanning four decades in real estate, excellence is not just a goal—it’s a tradition. Emily is committed to upholding the impeccable reputation her mother, Linda K. Martin, a top North Shore Chicago agent, has built by delivering nothing short of excellence to her clients.

Unwavering Dedication & Passion

Emily is dedicated to her clients’ success. From the moment they embark on this journey together, she provides unwavering support, guidance, and attention to detail, ensuring a seamless and stress-free experience. When asked to describe Emily, the first words that come to her clients ‘ minds are passionate, energetic, experienced, and dependable.

Explore the Luxury Lifestyle in Healdsburg’s Wine Country

Luxury real estate is not just about properties—it’s about a lifestyle. It’s about finding the perfect blend of elegance, sophistication, and comfort that feels like home. It’s the feeling clients get when they walk into their dream home.

Contact Sonoma Realtor Emily Martin today at: [email protected] or 707-926-3200 to begin an extraordinary real estate experience. Together, you’ll create a story worth telling, a life worth living, and a legacy worth building.