Home Selling Process

Deciding to sell

You are contemplating selling your home. Let’s first sit down and clarify your motivations and draw up a rough timeline that works for you.

Are you looking for more space, or is a different neighborhood calling your name? When we get clear on what’s driving this move, it helps me find the right path forward—one that actually fits your financial goals, your lifestyle, and what you’re really looking for in your next chapter.

If you need to move quickly, we can accelerate the process by providing you with a complete market analysis and action plan to achieve all your goals. If there is no pressing need to sell immediately, we can take our time, keep an eye on the market, and choose the moment that works best for you.

Pricing your home right from day one? That’s what brings serious buyers to the table and gets you the best return—without your home sitting on the market forever. I’ll dive into a full market analysis, looking at comparable homes, recent sales, and what’s happening right now in the market. From there, we’ll land on a price that makes sense for your timeline and hits your financial goals.

Let’s look at where you are financially right now—and where you want to be down the road. Together, we’ll estimate potential proceeds from selling your property, and plan effective tax savings and estate planning strategies. I’m here to help you see the full picture so you can make decisions with confidence. If you want to learn more, check out this Checklist After You Go Under Contract as a Seller.

WORK WITH A TRUSTED LOCAL REALTOR

Finding the right agent to sell your home? It matters—a lot. You need someone who knows the Healdsburg Real Estate community inside and out, lives in the community, is involved in the community, someone you actually trust and feel great working with. That’s where I come in. I’m here to make your real estate goals happen. With deep expertise in luxury properties, creative marketing that gets attention, and an approach that puts you first every step of the way, I bring something different to the table. Here’s what working together looks like:

My extensive luxury sales experience with brands such as Louis Vuitton, Tiffany, & Bloomingdales, high-touch bespoke customer service, innovative marketing perspective, hard work ethic, and passion allow me to provide a level of service truly distinctive in the luxury real estate market.

Storytelling is at the heart of what I do. I don’t just list homes on the MLS—I craft narratives that resonate with discerning buyers. Every property has a story worth telling, and I know how to share that. Video storytelling is my #1 differentiator, and it’s something most listing agents skip. Want your home seen by the largest pool of qualified buyers? Video is how we reach them!

2nd generation realtor

With a deep understanding of the luxury market and 25+ years of Luxury Sales & Marketing experience, I bring a wealth of knowledge and insight about luxury living, sales, marketing, and the wine country lifestyle. My extensive experience, hard work ethic, 2nd generation real estate insight, and passion allow me to provide a level of service truly distinctive.

With an MBA in Finance and Entrepreneurship, I bring an analytical perspective to every transaction. I help clients make data-driven decisions by examining each property through the lens of investment potential, transforming complex real estate decisions into well-informed choices.

Prepare to Sell

Keeping your landscape pristine and adding creative touches to your yard, such as colorful annuals, will create an immediate impact on passers-by and potential buyers.

Simple upgrades such as window repairs, polishing the doorknobs, update light fixtures, refreshed landscape, and a fresh coat of paint in the most frequently used rooms will instantly brighten up the property.

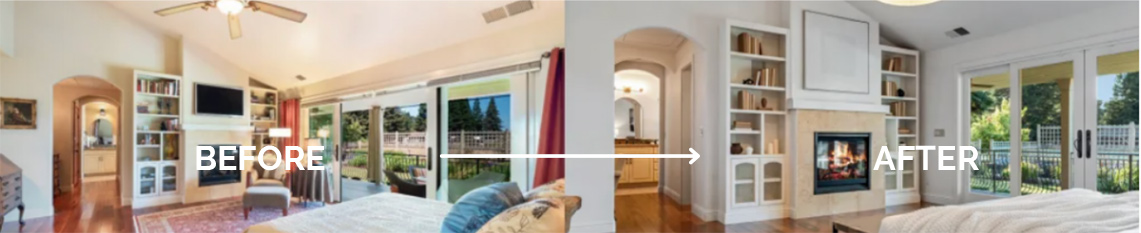

75% of sellers experience a 5% to 15% return on investment (ROI) when they professionally stage their homes before selling. So, stage your home to help buyers see the full potential of the space and generate an emotional connection.

We are familiar with the legal procedures involved in disclosures. We are ready to help you develop a thorough disclosure statement that benefits both you and the buyer, and to suggest home improvement measures before placing your property.

Presenting your home to potential buyers? That’s our job. We will keep you informed on everything—every inquiry, showing, and open house—and you’ll get weekly traffic reports with real metrics broken down by channel: YouTube, MLS, Zillow, and beyond. Full transparency, always.

How do we market & SELL your home?

We have a detailed process for properly marketing a home. As one of the top Sonoma County realtors with the largest social media following in Healdsburg Real Estate, we design a customized marketing plan for you and your property to capture the attention of the right potential buyers.

For more information, visit our detailed marketing plan to sell a home here.

Vendor & General Contractor Management for a Stress-Free Sale

Preparing a home for market can feel overwhelming—especially for second-homeowners who aren’t in town to supervise repairs, improvements, or staging. At Healdsburg Luxury Living, we don’t just list your home, we manage the entire preparation process so your property hits the market in peak condition without you having to be here.

Here’s what we take care of for you:

For cleaning, repairs, landscaping, staging, photography, and more. Check our partners here!

For larger updates or pre-sale improvements.

Scheduling, supervising, and verifying workmanship to ensure every detail meets market-ready quality.

Providing updates, photos, and video walkthroughs so you can make decisions confidently from anywhere.

Overseeing timelines and budgets to keep everything running smoothly before your listing goes live.

Accepting an Offer

The higher the price, the better the offer.” Don’t fall for it. Price isn’t everything, and here’s why: that initial number is rarely the final one. Terms and conditions matter just as much—sometimes more. Is it a cash offer, or are they financing? What contingencies are in play? How quickly can they close? All of this shapes what you actually walk away with.

I’ll help you evaluate every offer with a critical eye, looking at all the variables that matter. Together, we’ll choose the one that’s truly best for you—not just the flashiest number on paper.

We take the ethical responsibility of fairly negotiating contractual terms very seriously. It is our job to find a win-win agreement that benefits all parties involved. You may even have to deal with multiple offers before ratifying the one you judge to be the most suitable for you – and as your agent, I’ll give you a thorough, objective assessment of each one, breaking down what matters so you can make the right choice with confidence. This is about protecting your interests while keeping the deal moving forward.

An effective agreement is a legal arrangement between a potential purchaser and the property’s seller. Laws vary from state to state, but in order to be a legally, binding agreement, the agreement may require consideration. This consideration (initial and additional deposit) is to be held in the closing agent’s escrow account pending the fulfillment of conditions or contingencies in the effective agreement.

Some important tips to keep in mind to streamline the process even further:

For the sake of clarity, it will be extremely useful to transcribe all verbal agreements including counter-offers and addendums, and convert them to written agreements to be signed by both parties. We will assist you in drafting all the paperwork for your sale and make sure that you have copies of everything. Our T.C. (Transaction Coordinator) handles all the contracts, docusigns and other legal documents you will be receiving during the escrow process.

Once you’ve accepted an offer, our transaction coordinator (T.C.) will create a detailed timeline with every critical date marked—inspections, deposit deadlines, insurance requirements, closing day, all of it. This timeline is your roadmap. It keeps everything moving smoothly, protects you from missing key deadlines, and ensures everyone holds up their end of the deal. You’ll always know what’s happening and when.v

Escrow inspections & appraisals

Inspections and Appraisals

Most buyers will have the property inspected by a licensed property inspector within the time frame that was agreed upon in the contract to purchase. Some buyers will have several different inspectors inspect the property, if they wish to obtain professional opinions from inspectors who specialize in a specific area (eg. Pool, Pest, Roof, HVAC…).

If the agreement is conditional upon financing, then the property will be appraised by a licensed appraiser to determine the value for the lending institution via a third party. This is done so that the lending institution can confirm that their investment in your property is accurate.

The ESCROW Agent

If the agreement is conditional upon financing, then the property will be appraised by a licensed appraiser to determine the value for the lending institution via a third party. This is done so that the lending institution can confirm that their investment in your property is accurate.

- Certify that your title is free and clear of encumbrances (eg. mortgages, leases, or restrictions, liens) by the date of closing.

- And all new encumbrances are duly included in the title.

Contingencies

A contingency is a condition that must be met before a contract becomes legally binding. For instance, a buyer will usually include a contingency stating that their contract is binding only when there is a satisfactory home inspection report from a qualified inspector or that perhaps they have to sell their home in order to move forward with buying your home.

Before completing his or her purchase of your property, the buyer goes over every aspect of the property, as provided for by purchase agreements and any applicable addenda. These include:

- Obtaining financing and insurance;

- Reviewing all pertinent documents, such as preliminary title reports and disclosure documents, and

- Inspecting the property. The buyer has the right to determine the condition of your property by subjecting it to a wide range of inspections, such as roof,termite/pest, chimney/fireplace, property boundary survey, well, septic, pool/spa, arborist, mold, lead-based paint, HVAC, etc.

Depending on the outcome of these inspections, one of two things may happen:

- Either each milestone is successfully closed, and the contingencies will be removed, bringing you one step closer to the closing.

- The buyer, after reviewing the property and the papers, requests a renegotiation of the terms of the contract (usually the price) or cancels their offer.

How do you respond objectively and fairly to the buyer when a renegotiation is demanded, while acting in your best interests? This is when a professional listing agent can make a real difference in the transaction outcome. Having handled various property sales in the past, we guarantee our expertise and total commitment to every customer, no matter their situation.

Loan Approval and Appraisal

We recommend that you accept buyers who have a lender’s pre-approval, approval letter, or written loan commitment, which is a better guarantee of loan approval than no documentation from a lending institution. Expect an appraiser from the lender’s company to review your property and verify that the sales price is appropriate.

Close of escrow

If you have come this far, this means that it is almost time for congratulations, but not yet. Do not forget to tie up these loose ends:

The closing agent will furnish all parties involved with a settlement statement that summarizes and details the financial transactions enacted in the process. The buyer(s) will sign this statement, and you will sign, as well as the closing agent, certifying its accuracy.

If you are unable to attend the scheduled closing, then arrangements can be made depending on the circumstances and the notice that we receive. If you are receiving funds from the transaction, you can elect to either have the funds wired electronically to an account at your financial institution or have a check issued to you at the closing.